Accelerate Performance with Options & Protection

LegacyAccel® Indexed Universal Life (IUL) is a customizable vehicle providing life insurance protection with cash value acceleration opportunities.

Electronic Application

LegacyAccel® is fully streamlined to get you and your client an immediate underwriting decision on the spot!

Liquidity

Liquidity is built-in with cash value loans and penalty-free withdrawals. If your client changes their mind later and decides to cash out the policy, a few features help to provide the maximum surrender value.

Customer Value & Growth

LegacyAccel® helps pass a ramped-up legacy as a death benefit to the next generation. Also provides accelerated cash value accumulation opportunities with a minimum return of 2.5%.

Chronic Illness Rider

A lump sum payout is available to help with expenses for a serious illness, should that event arise.

Tax-Free Legacy

You can get the dual advantage of a ramped-up death benefit while at the same time taking maximum advantage of accelerated cash accumulation.

Eligibility

Issue Ages: Age last birthday 18-85

Male and Female gender specific rates (except in Montana) in four classes:

- Standard Nicotine

- Preferred Nicotine

- Standard Non-Nicotine

- Preferred Non-Nicotine

Premium Modes: Single Premium or Annual Installments.

Loads & Charges: LegacyAccel® is a no-load plan with unbundled expense charges. Surrender charges may apply.

Maturity Age & Value: Policy matures at age 121 for the current death benefit.

Safety Features

Living Benefit Rider

A portion of the Death Benefit may be accelerated in the event of chronic illness, terminal illness or severe cognitive impairment. The lesser of $500,000 or 90% of the specified amount could be accelerated.

Liquidity

LegacyAccel® has liquidity built-in with cash value loans and withdrawals. If you change your mind in the fifth policy year or later and decide to cash out your policy, the Waiver of Surrender Charges, Accumulated Value Roll-Up and Premium Protection features help to assure that you realize the maximum surrender value (as long as the surrender is not a transfer to a policy at another company).

A Minimum Return of 2.5%

A minimum return of 2.5% may be provided with the Accumulated Value Roll-Up Rider. Every tenth year, or at surrender, the Rider provides the greater of the original policy premiums (minus withdrawals, fees and expense charges) credited at a guaranteed return of 2.5%, or the current accumulated value – whichever is greater.

Marketing Materials

Download pdf marketing materials below. Additional resources are available for appointed advisors at the UnitedLife.com Agent portal.

Product At-A-Glance

An all you need to know, handy six page brochure which includes four performance features, details of the plan, eligibility, crediting options and rider information.

Advisor Guide

A sixteen page brochure highlighting opportunities to accelerate performance with options and protection.

Case Study

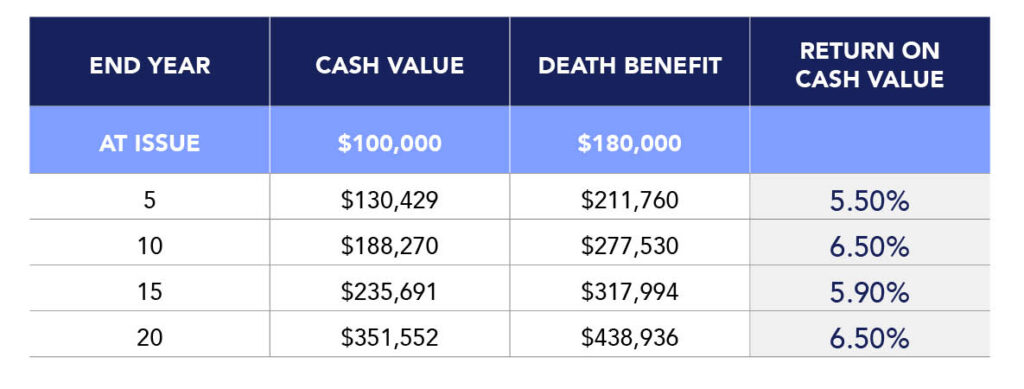

Paul is a 60-year-old male who is a healthy non-tobacco user.

Paul’s Goals:

Pass money to his kids in a tax-efficient manner while also having competitive growth and access – just in case he needs the money later.

Solution:

United Life’s LegacyAccel® IUL, which provides the potential for strong cash value accumulation, liquidity and more.

Assumptions:

- $100,000 single premium, all allocated to S&P 500® MARC 5% Excess Return Index with 140% Participation.

- $180,000 initial specified amount for a Standard Non-Nicotine rate class with no withdrawals or policy changes.

- Calculations are based on non-guaranteed elements, including back-tested MARC 5 Index values from the last 20 years (12/31/2000 to 12/31/2021). Actual results may vary.

Paul's LegacyAccel® Policy Values and Benefits:

Actual results will vary. Past performance does not predict/assure future results.

More Features:

A Living Benefit Rider may be included for chronic illness benefits, AND a minimum return of 2.5% may be provided with the Accumulated Value Roll-Up Rider.

The S&P® MARC 5% Excess Return Index are products of S&P Dow Jones Indices, LLC, a division of S&P Global, or its affiliates (“SPDJI”) and have been licensed for use by United Life Insurance Company. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). United Life Insurance Company’s insurance products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500® Price Return Index and S&P® MARC 5% Excess Return Index. Benefits are only generally described here and require underwriting approval. Product and rider availability may vary by state. Please read the policy for exact details on benefits and exclusions. If there is a discrepancy between the product as it is generally described here and the policy or rider issued to you, the provisions of the policy or rider will prevail. Product issued by United Life Insurance Company. ICC20 FPIUL-BC